Simplify Crypto Tax Preparation with Blockscout

Filing taxes can be a hassle, especially if you're into trading and holding cryptocurrencies. Keeping track of all those transactions across different networks can get messy. But don’t worry! Blockscout makes it super easy to access your blockchain data and lets you export your transaction history, which is a big help during tax season.

This article shows you how to use Blockscout to easily download your transaction and token transfer history as CSV files. It’ll also cover how to use this info for accurate tax reporting and point out the main data you’ll find in these exports.

Step 1: Identify Relevant Chains Using Zerion

Before jumping into exporting CSVs, let's identify which blockchain networks you’ve been using. Tools like Zerion (or similar portfolio tracking tools) give you an easy overview of all your crypto assets and transaction history from different chains.

Connect your wallets to Zerion

- Go to Zerion

- To begin, click on the "Connect Wallet" button. Then, follow the instructions provided by Zerion to connect all the cryptocurrency wallets you have utilized during the tax year.

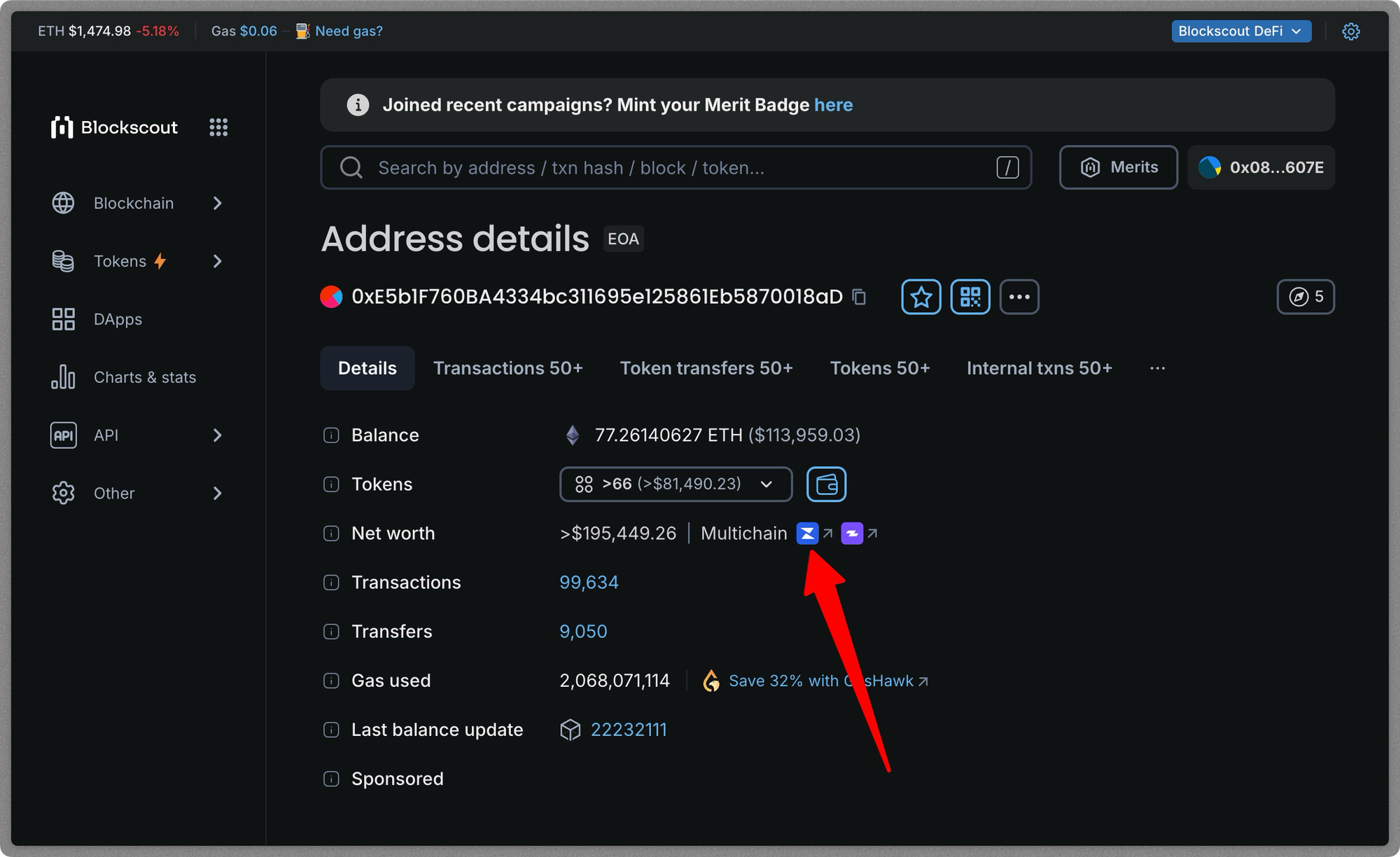

Alternatively, you can access Zerion directly from the address page on Blockscout.

Paste your wallet address into the explorer and go to the address page; the blue icon takes you directly to the Zerion dashboard without needing to connect your wallet or log in.

Note: You can add multiple wallets and track them all on your dashboard

Review your transaction history

Once your wallet is connected, Zerion will present a comprehensive overview of your transaction history across different blockchain networks. Take a moment to carefully examine all the different blockchain platforms where you've engaged in activities.

Click on “All Networks” button to view the networks on which you made transactions.

Step 2: Export CSV Data from Blockscout

Now that you know which chains to focus on, you can use Blockscout to export your transaction history for each of them.

Navigate to the specific Blockscout instance

For each blockchain network identified in Zerion, you need to access its corresponding Blockscout explorer. Search for the specific blockscout instance in Chainscout.

- Search for your wallet address: Locate the search bar on the Blockscout explorer for the specific chain (we start with Ethereum for this example). Enter the public address of the wallet for which you want to export the transaction history and click "Enter."

The search results will lead you to a page dedicated to your wallet address, providing an overview of your balance and transaction history.

- Initiate the CSV export: You only need the CSV files from your transactions and Token transfers for your taxes. Click on their respective buttons to download the CSV files.

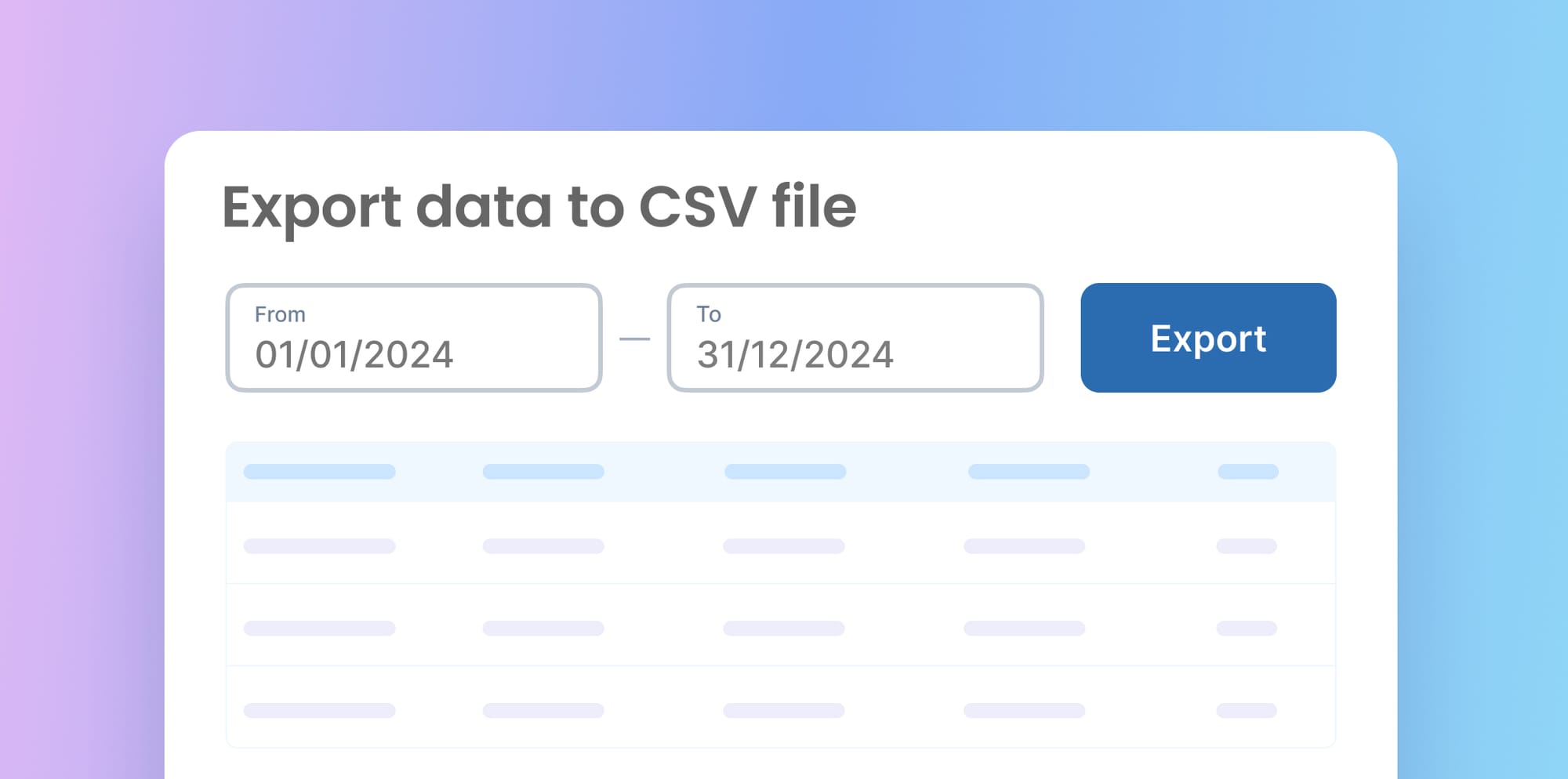

- Download the CSV file: When prompted, ensure you set the export date range to cover the entire tax year: January 1, 2024, to December 31, 2024. Blockscout provides calendar pickers to set these dates.

After specifying the date range, click the "Download" button. Blockscout will generate and download the CSV file to your computer.

Step 3: Understanding the Information in the CSV Files

The downloaded CSV files contain information about your blockchain activities, including transaction details, timestamps, and wallet addresses. Let's take a closer look at what these values mean.

The CSVs are uploaded to a spreadsheet for a more detailed view.

For Transaction CSVs:

- Txn Hash (Transaction Hash): A unique identifier for each transaction on the blockchain. This is essential for referencing and verifying transactions.

- Block Number: The block number in which the transaction was included.

- UnixTimestamp: The precise date and time when the transaction was recorded on the blockchain. This info is essential for assessing the asset value at that moment.

- FromAddress: The sender's wallet address.

- ToAddress: The recipient's wallet address or the contract address interacted with.

- ContractAddress: The address of the contract for the type of transaction e.g. ERC20

- Type: This indicates whether a transaction is incoming or outgoing.

- Value: The amount of the native blockchain token involved in the transaction; it is not denominatd in USD, but rather in the raw token amount.

- Txn Fee (Transaction Fee): The total cost of the transaction, calculated as Gas Price * Gas Used. This is usually denominated in the native blockchain token. This is the price of the token at the exact date/time of the transaction.

- Current Price: The current (latest) market price of the token in USD at the time you downloaded the CSV.

- TxDateOpening: The price of the token in USD at the exact date/time of the transaction.

- Method Name: The smart contract method used for the transaction.

For Token Transfer CSVs:

The Token transfers CSV has similar values to the transactions CSV; let’s highlight the few fields that differ.

- Token Symbol: The symbol of the transferred token (e.g., USDT, DAI, LINK).

- Token Decimals: The number of decimal places used by the token. This is important for interpreting the token value correctly.

- Token Transferred: The amount of tokens transferred.

Step 4: Categorizing Transactions for Tax Purposes

After downloading the CSV files for your chains, the next step involves categorizing and tracking transactions for tax reporting. This process requires identifying the nature of each transaction (such as a purchase, sale, or swap) along with its corresponding value in the local fiat currency at the time of the transaction.

The manual categorization and tracking of each transaction using spreadsheets can prove to be labor-intensive, particularly for individuals engaging in a high volume of trades or those involved in more intricate decentralized finance (DeFi) activities.

Fortunately, cryptocurrency tax software solutions are available to automate and streamline this process. Users can upload CSV files exported from Blockscout, providing an efficient alternative to manually entering transactions or connecting their wallets.

The following are popular tax applications you might consider.

CoinLedger

CoinLedger is a tool that streamlines the process of cryptocurrency tax reporting and portfolio management. It enables users to effortlessly connect their cryptocurrency exchange accounts and wallets, which allows for automatic synchronization of transaction data.

Additionally, for platforms without direct API integration, CoinLedger allows the import of transaction histories through CSV files, making it a versatile solution for managing cryptocurrency records. You can learn more about how to upload your CSV files in this guide.

Koinly

Koinly is a cryptocurrency tax software designed to assist individuals in calculating taxes owed on crypto transactions worldwide. It integrates with hundreds of exchanges, wallets, and blockchains to automatically import and consolidate a user's complete transaction history.

By reconciling this data and applying specific tax rules for each country, Koinly generates comprehensive tax reports, making the process of reporting capital gains, losses, and income from crypto activities easier.

CoinTracker

CoinTracker is a cryptocurrency tax software designed to assist individuals in calculating their tax deficits from crypto transactions. It streamlines the process by importing transaction data directly from a variety of exchanges, wallets, and blockchain platforms. The software then automatically computes capital gains and losses, generating necessary tax reports.

Conclusion

Blockscout serves as a highly useful resource for exporting your blockchain transaction history in a well-structured format. By integrating this data with the chain identification functionalities offered by platforms like Zerion, you can effectively compile the essential information needed for thorough tax preparation.

It’s important to emphasize that precise categorization and accurate valuation of your transactions are vital for compliant reporting. While Blockscout streamlines the process of data retrieval, utilizing dedicated tax software remains an indispensable step to ensure that your financial records align with regulatory requirements.